Locating your bank account and routing numbers is simple, even if you don’t have a check on hand. Whether you’re online or using your mobile banking app, there are several ways to find these important numbers. In this guide, we’ll show you how to easily access your account and routing numbers step by step. Keep reading to learn all the methods for retrieving these details, including online options, checks, and mobile banking apps.

1.Locating Your Account Number

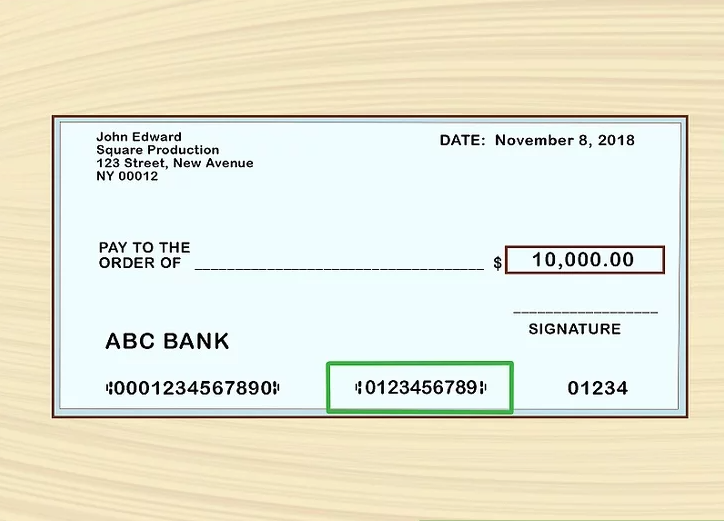

- Locate the second set of numbers at the bottom of your check if you have one. The first set, found on the left side, is the bank’s 9-digit routing number. The second set, typically 10 to 12 digits long, is your account number. The final, shorter set represents the check number.

The account number will usually be enclosed in identical symbols, such as this example: “⑆0123456789⑆”.

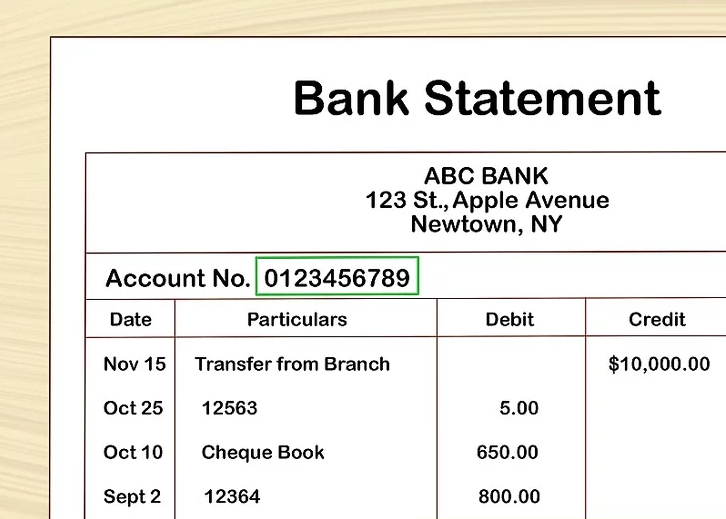

2.Check your digital or paper bank statement if it’s readily available. Your account number will be included on every statement, whether it’s an electronic version in your inbox or a physical one in your mailbox. Simply find a recent statement and look for a 10 to 12-digit number labeled as “Account Number,” typically located near the top of the document, either on the left or right side.

3.Access your account through a mobile banking app or website to find the number online. Visit your bank’s website on your computer or open their mobile app on your phone or tablet. Log in, and go to the section that shows an overview of your account. The account number is typically displayed here. If you can’t find it, try searching the site or using the “Help” feature for assistance.

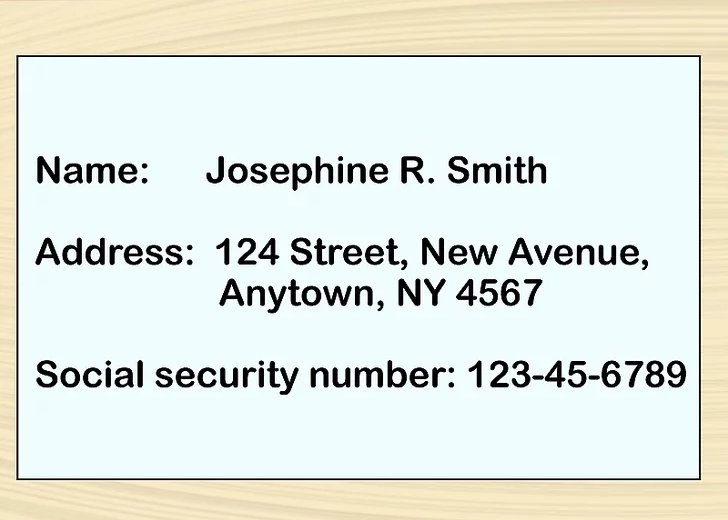

- Reach out to your bank if you’re unable to find the number. Call the customer service number found on the back of your credit or debit card, or look it up online. You may be asked to provide your name, address, and social security number to verify your identity. Once verified, the bank representative will provide you with your account number.

If you choose to write it down, make sure to keep it in a secure place, such as your wallet or a filing cabinet.

2.Keeping Your Account Number Safe

1.Always use a secure internet connection when accessing your accounts online. While it may be tempting to check your bank details from a coffee shop, store, or train station, it’s best to avoid doing so. Unsecure public Wi-Fi networks can leave you vulnerable to identity theft. Only access your accounts when you’re connected to a secure and trusted internet connection, whether online or through a mobile app.

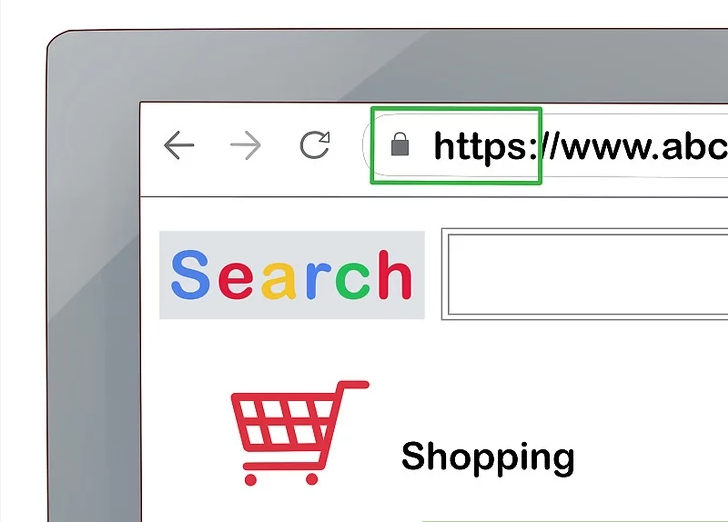

- Only share your account number on secure websites. If you need to provide your account number online for tasks like paying bills or transferring funds, ensure the website is secure. The web address should start with “https,” where the “s” indicates it’s a secure connection. Look for a padlock icon and/or the word “Secure” in the address bar before entering your account number.

If these security indicators are missing, avoid entering your account details, as your information may not be protected. Also, be cautious of online shopping sites that ask for your account number—this is usually unnecessary.

3.Stay on top of your checks and bank statements. Avoid leaving your checkbook or bank statements unattended in your home or car. Instead, review your statements as soon as they arrive, then store them, along with any other documents containing your account information, in a secure location like a filing cabinet. Keep your checkbook in a safe spot as well. Remember to shred old checks and bank statements instead of recycling or discarding them, to prevent anyone from accessing your account details.

4.Regularly monitor your account for any signs of fraud. It’s crucial to review your checking and savings account statements frequently to ensure all charges are correct. If you notice any unauthorized transactions, contact your bank right away for further assistance.

1 thought on “How to Find Your Bank Account Number”